【文章摘要】This paper takes China’s A-share listed companies of the mixed ownership of state-owned enterprises from 2007 to 2016 as a sample, and examines the impact of state-owned business mixed reform on corporate performance. Research shows that under dierent equity restriction ratios, thereexists a dierence in the connection between corporate performance and equity restriction ratio. Corporate performance reduces with the subjoin of equity restriction ratio, and they are negatively correlated when the stockholding ratio of the largest stockholder is less than 25%; on the condition that the stockholding ratio of the largest stockholder is in the range of 25 and 40% and 40 and 60%, it presents an “inverted U-shaped” connection between corporate performance and equity restriction ratio. At this time, the threshold value of the optimal equity restriction ratio is 1.1336 and 0.7297, respectively. On the condition that the stockholding ratio of the largest stockholder is equal to or more than 60%, there exists no threshold value for equity restriction ratio. However, the regression results present that corporate performance increases with the increase of equity restriction ratio, and the two are positively correlated.

【文章信息】Zhou, B.; Peng, M.; Tan, Y.; Guo, S.; Huang, S.; Xue, B@. Dynamic Panel Threshold Model-Based Analysis on Equity Restriction and Enterprise Performance in China [J]. Sustainability 2019, 11, 6489. https://doi.org/10.3390/su11226489

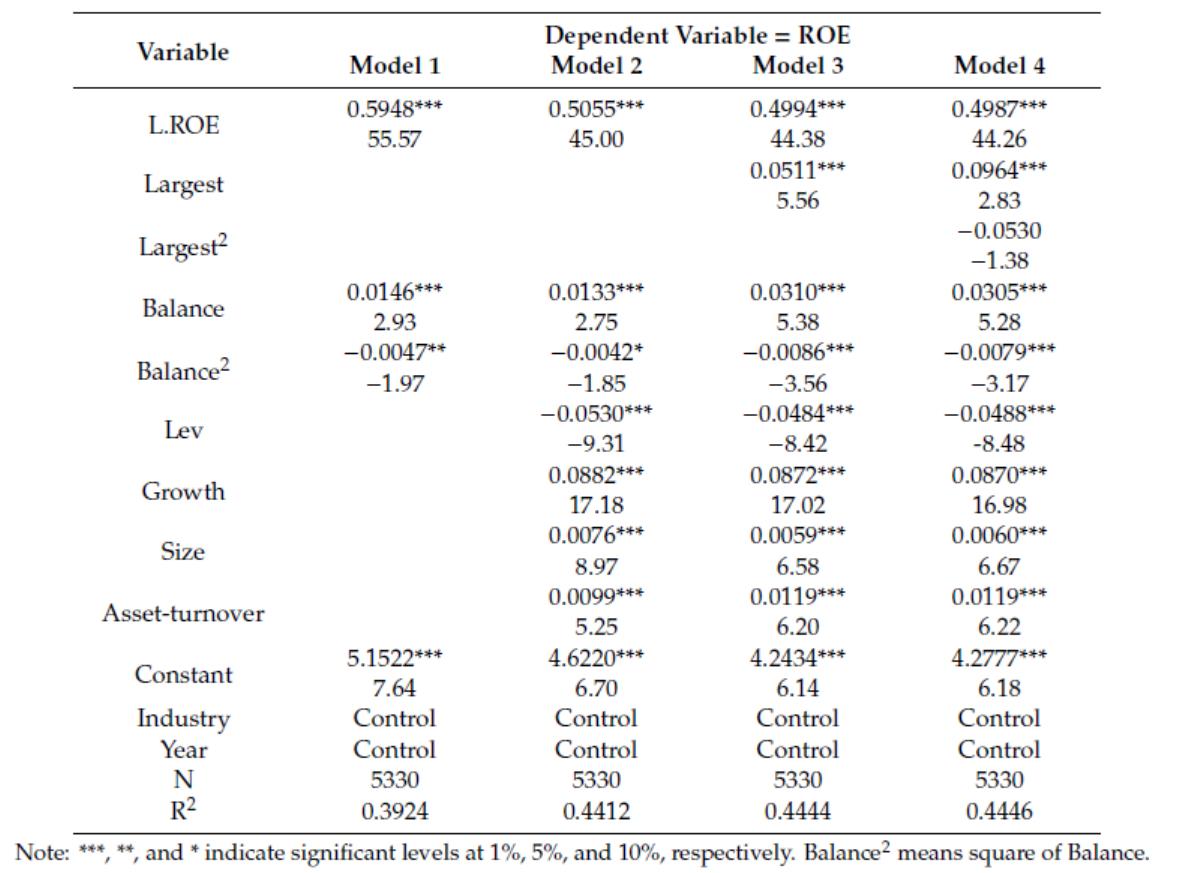

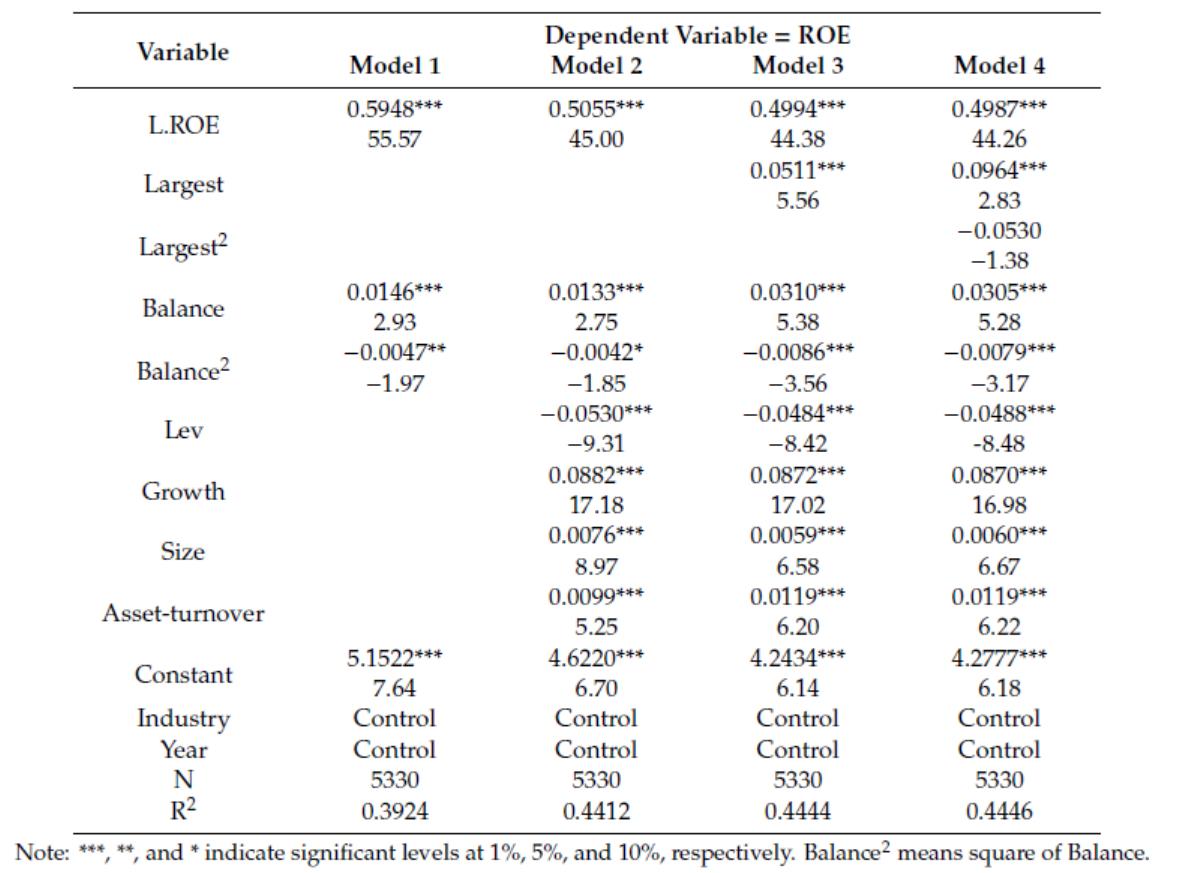

Table: Single threshold model regression results.